India's main opposition Bharatiya Janata Party (BJP) activists sit with placards at a protest in New Delhi, India, Monday, Nov. 28, 2011. India's new open door policy for foreign retailers is stirring a backlash across the political spectrum from state governments who fear the move will be unpopular with their constituencies of small traders and shop owners. (AP Photo/Gurinder Osan)

India's main opposition Bharatiya Janata Party (BJP) activists sit with placards at a protest in New Delhi, India, Monday, Nov. 28, 2011. India's new open door policy for foreign retailers is stirring a backlash across the political spectrum from state governments who fear the move will be unpopular with their constituencies of small traders and shop owners. (AP Photo/Gurinder Osan)

India's main opposition Bharatiya Janata Party (BJP) activists raise slogans as they sit with placards at a protest in New Delhi, India, Monday, Nov. 28, 2011. India's new open door policy for foreign retailers is stirring a backlash from state governments who fear the move will be unpopular with their constituencies of small traders and shop owners. (AP Photo/Gurinder Osan)

MUMBAI, India (AP) ? A broad and fiery backlash against India's new open-door policy for foreign retailers sparked fresh investor fears Monday about political risk and the stability of the Congress Party's coalition government.

The new regulations don't require Parliamentary approval, but to set up shop, foreign retailers such as Wal-Mart and Carrefour must be approved by the government of the state where stores will be located.

Five state leaders made clear over the weekend their unwillingness to let in foreign companies. Leaders from two of Congress' main coalition allies oppose the policy. Parliament adjourned Monday in an uproar over the issue and Communist Party-controlled trade unions have pledged to strike Thursday. Some politicians even threatened to burn down foreign stores that open under the new rules.

The fury of opposition is adding to foreign investor fears about the political risks of doing business in India. Some analysts say the Cabinet may have to backtrack on its bold new rules, which would be a political embarrassment for a government straining to reassert its leadership in the face of corruption scandals, high inflation and flagging growth.

"We are waiting for clarification of the rules related to FDI," Jean-Noel Bironneau, the managing director of Carrefour India, said Monday. "We prefer to assess the situation."

The new rules would allow big retailers such as Wal-Mart to set up supermarkets in India's major cities and will likely herald the entrance of companies like Swedish retailer Ikea, which has been keen to come for years, but only if it can maintain control of its operations.

In a letter to political leaders, Minister of Commerce Anand Sharma cast the change as a boon for consumers and farmers ? who constitute large sections of the voting public ? rather than a threat to small traders.

"A complex chain of middlemen have a cascading impact on supply inefficiencies and prices," he wrote. "(F)armers are unable to secure remunerative price for their produce, while consumer ends up paying more than 5 times the price secured by the farmers."

He said that in other emerging economies where foreign direct investment is permitted in retail, like China, Brazil, Argentina, Singapore, Indonesia and Thailand, local retailers have not been put out of business.

He has said that states like Punjab, Haryana, Rajasthan and Maharashtra ? home to India's financial capital, Mumbai ? support the policy.

The changes could also help domestic players who have struggled to succeed on their own.

Future Group Chief Executive Kishore Biyani, who has been likened in India to Wal-Mart and Sam's Club founder Sam Walton, welcomed the entry of foreign chains. "This policy is a win-win-win," he told The Associated Press. "It's a win for consumers, a win for retailers, a win for suppliers and a win for farm producers. Ninety percent of India should benefit."

Biyani would not discuss details of his negotiations with foreign partners, but said he's open to forging joint ventures, particularly in consumer electronics, where he'd like to become the market leader.

The debt-laden Future Group has 16 million square feet of retail space and is growing by 2 to 2.5 million square feet a year, he said. "We can now grow faster," he said.

The central government has taken out advertisements to quell critics, championing the new rules as a way to make food cheaper for everyone, eliminate waste that claims up to 40 percent of all fresh produce, and create millions of jobs.

The leaders of the states of Tamil Nadu, Uttar Pradesh, Kerala, Orissa and West Bengal have all publicly opposed the ruling Congress Party's move to let foreign retailers own up to 51 percent of supermarkets and 100 percent of single-brand stores, according to the Press Trust of India.

India's main opposition BJP party as well as the Congress Party's coalition ally, the Trinamool Congress, have also voiced opposition. India's Hindustan Times newspaper calculated that 28 of the 53 cities where retailers could set up under the new rules are in states controlled by political parties opposed to the regulations.

Some say the wave of opposition won't scuttle the changes, which foreign retailers have been pushing for a decade.

"There are enough states which would be positively inclined," said Saloni Nangia, head of retail and consumer products at Technopak Advisors, a New Delhi based consulting company. "Retailers will take some time before they start implementing. By then things would settle down."

Other analysts say global economic uncertainty may prove a stronger immediate disincentive.

Tamil Nadu's chief minister J. Jayalalithaa in a letter Sunday to Prime Minister Manmohan Singh said she wouldn't let retailers into her state, describing the central government's move as a "wrong decision, taken under pressure from a few retail giants starved for capital infusion for their future survival," according to the Press Trust of India.

Mayawati, the fiery leader of Uttar Pradesh, said foreign investment in retail would make her state "bankrupt." She is locked in a battle with the Congress Party over upcoming state elections.

The chief minister of Kerala, which is controlled by the Congress Party, also came out against the changes.

Narendra Modi, the chief minister of Gujarat, has been silent on the issue. Though he is renowned for being business friendly and actively seeking foreign investment, a major constituency of his BJP party are the small traders and mom and pop shops that many fear will be put out of business if companies such as are allowed greater access.

The government tried to design the new retail policy so that the price of entry into India's 1.2 billion-strong consumer market would be improving the nation's food distribution and bolstering local businesses.

Under the new regulations, retailers must put at least half their investment into back-end infrastructure such as refrigerated storage, with 30 percent of procurement from small companies, and they can only open outlets in cities with a population of more than 1 million.

Technopak says the new rules could attract $5 billion in investment over the next five years.

The work facing new arrivals is formidable. Besides navigating political uncertainty, they must develop supply chains from scratch, improve supplier efficiency, set up logistics in a nation which needs better roads, train an uncomprehending work force and find appropriate, affordable retail locations in urban centers.

Wal-Mart, Tesco, Carrefour and Germany's Metro may have an advantage over other foreign retailers if they decide to expand their India operations as they already have wholesale businesses in the country.

Associated Presswhere do i vote wheel of fortune today show smokin joe conrad murray verdict tappan zee bridge philadelphia eagles

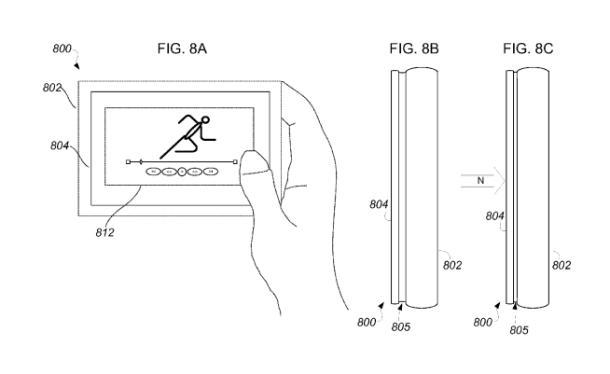

Good news for the Donald LeBuhns of the world, newly uncovered patents filed by Apple show the company has been thinking about upping durability for portables. Future iOS devices may even be getting little airbags installed to prevent your precious mobile electronics from shattering on the first drop.

Good news for the Donald LeBuhns of the world, newly uncovered patents filed by Apple show the company has been thinking about upping durability for portables. Future iOS devices may even be getting little airbags installed to prevent your precious mobile electronics from shattering on the first drop.